Taxes, Subsidies or Regulation: Why have Britain’s carbon emissions from electricity halved?

We would like to warmly thank Dr Iain Staffell, a multidisciplinary scientist working at the Centre for Environmental Policy at Imperial College London, for his visit to the ISTP and his fascinating and insightful talk on what drove Britain's massive power sector decarbonization between 2012-19 and the lessons for other countries with heavy fossil-fuel dependency.

by Felix Zaussinger

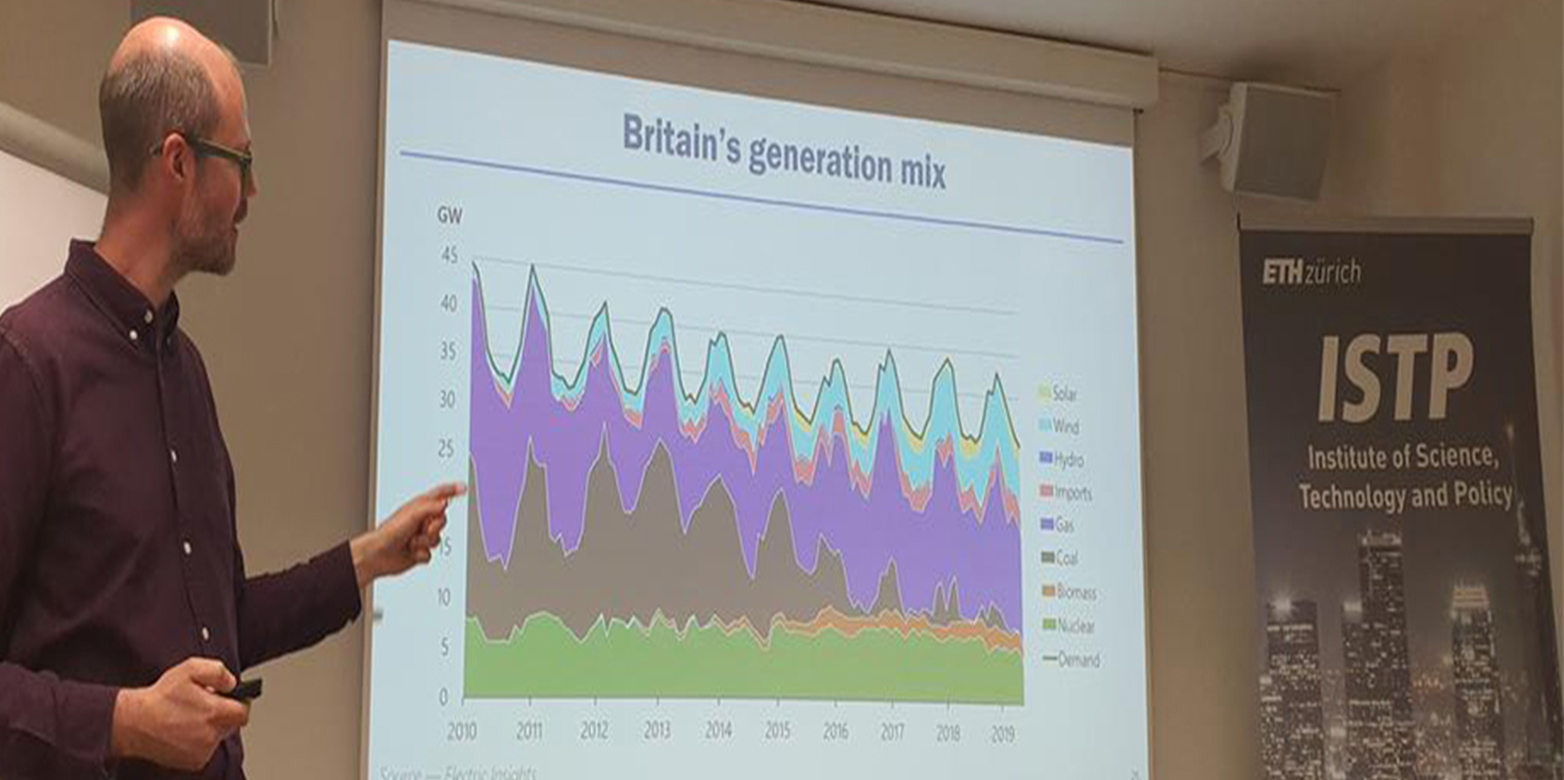

Dr Iain Staffell, a multidisciplinary scientist working at the Centre for Environmental Policy at Imperial College London, was greeted by a full house at last week’s ISTP colloquium. Starting off his talk with a critical question, he asked: “Do we have clean electricity?”. After presenting the latest data on how global carbon intensities have been evolving lately, Dr Staffell quickly concluded: “The global picture is not looking good.” Although in some countries renewable energy growth rates have been quite spectacular, with Germany winning the race, we have only seen a 5% reduction in global carbon intensity during the last decade. Coal still provided 40% of electricity throughout the last 30 years – “a pretty bad news story”. However, there are success stories as well: initiated by its national Climate Change Act 2008, which aims at an 80% CO2 emission reduction by 2050 - compared to the 1990 baseline - the United Kingdom has seen the fastest power sector transformation towards renewable energy over the last decade. “And this from the country that started the industrial revolution”, the spirited researcher remarked as a side note. Dr Staffell’s talk was all about resolving the question marks associated with the causes of this rapid decarbonisation. What drove down CO2 emissions? What drove up electricity prices? Was it renewables’ subsidies, carbon taxes or even changes in demand?

Econometric electricity market modeling and cooperative game theory

To address these questions, Dr Staffell used two fundamental concepts: an enhanced Merit Order Stack (eMOS) and Shapley theory. A MOS is a model that ranks the supply of power stations in accordance with their cost of generation and always selects the cheapest available station to meet demand. A drawback of its basic formulation (bMOS) is that it tends to overestimate the utilization of cheap power stations. Therefore, the researcher incorporated heuristics that interleave supply from different power stations by spreading out the tranches of bids – now dubbed enhanced MOS or eMOS. To quantitatively attribute the drivers of CO2 emissions reductions and electricity price changes, he used Shapley values, a concept from cooperative game theory. The advantage compared to similar attribution strategies is that non-linear contribution can be taken into account. In simple terms, the Shapley theory asks the following two questions: What does every single person in a coalition bring to the table and how much does the value of the coalition increase if you add one person? By replacing the coalition with electricity prices and capacities of coal, gas, wind and solar, as well as carbon prices and electricity demand, and substituting the coalition’s value by carbon emissions and electricity prices respectively, Dr Staffell was able to quantitatively attribute the drivers of UK power market changes for the period 2012-2018.

Driver attribution: what caused CO2 emissions to fall and electricity prices to rise?

His analysis revealed surprising insights: regarding the 97,8 Mt reduction of CO2 emissions between 2012 and 2018, an EU regulation on clean air, which led many UK coal factories to shut down, accounted for the largest emission reduction of 28,4 Mt CO2. Another 26,8 Mt CO2 were attributed to renewables subsidies, 19,9 Mt CO2 to wind energy and 6,9 Mt CO2 to solar and reductions in demand due to climate change, efficiency increases and local deindustrialisation led to another 19,3 Mt CO2 decrease. Intriguingly, carbon prices only accounted for a 15,1 Mt CO2 reduction, whereas increasing coal and gas prices reduced emissions by 9,9 Mt CO2 (Model fit: +1,7 Mt CO2). In the same time period, electricity prices rose by 11,62 £MWh. Here, decreases due to lower coal/gas prices (-1,68 £/MWh), increased wind (-5,36 £MWh) and solar (-2,32 £/MWh) capacity and electricity demand (-4,75 £/MWh) were balanced out by price increases due to higher carbon prices (15,35 £/MWh) and lower coal/gas capacity (9,06 £/MWh) (Model fit: +1,32 £/MWh).

Can the UK taxpayers afford renewables subsidies?

Generous government support schemes were needed to drive these developments. So, from a tax payer’s perspective: what is the impact of policy instruments on consumer electricity prices? Based on Dr Staffel’s calculations, supporting wind energy has cost everyone an extra 4,60 £/MWh, while support in solar energy came at a cost as low as 0,5 £/MWh. Next, he confronted renewables subsidy costs with their estimated CO2 emission savings. Wind energy came in at 147 £/t CO2, solar at 120 £/t CO2, while savings through CO2 prices were much cheaper at 14 £/t CO2, presumably due to non-linear interaction effects with fossil fuel prices. These results point to a generally well-accepted hypothesis among economists: renewables policies, particularly targeted at specific technologies, are not particularly economically efficient.

Lessons learned

“There are lessons in here that other countries could learn”, Dr Staffell said as a closing point, “to get countries from a trajectory of a slight decline to aggressive emission reductions that are in line with what’s needed to limit global warming to 2°C or even 1.5°C”. Surely, there are also lessons that the UK could learn from others. Tobias Schmidt, Professor for Energy Policy at ETH Zurich posed the final question of the Q&A session: what will happen to the current trajectory of the UK energy market after Brexit? Dr Staffell replied that it will likely make decarbonising harder and cynically concluded: “Once we start eating each other, emissions are going to go down.”

On behalf of the whole ISTP, I would like to cordially thank Dr Ian Staffell for his truly engaging talk. His work addresses one of the most critical issues of your time: to foster a net-zero emis-sions energy economy by 2050, we really need to figure out which policy instruments work and which don’t – and we need to do so at an unprecedented pace. We hope to soon welcome Dr Staffell back at ETH and continue the exchange on what instruments an effective energy policy designer’s toolbox should ideally entail.

To get a broadened sense of the ISTP and our topics of interest and past seminars visit our Colloquium page.